Table of Content

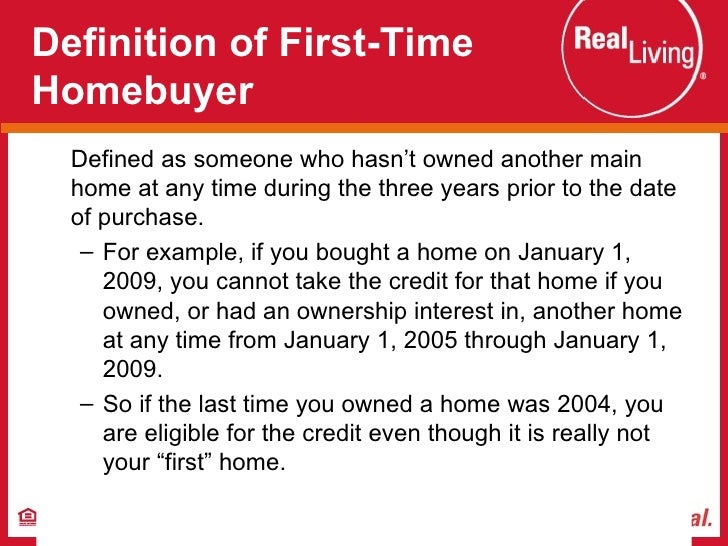

Any federal debt must be in good standing in order to get a government-based mortgage. If your tax debts have moved into the status of a tax lien, this will prevent you from getting a home loan until it is resolved. Homeownership Voucher Program provides assistance in the form of home buying subsidies to first time home buyer low-income families. Most programs in Arizona require a score of 580 to 680, but some will accept a lower score. And some programs use criteria other than credit scores to determine a borrower’s eligibility. For most programs offered in Arizona, like elsewhere in the country, applicants are considered first-time homebuyers if they haven’t owned a principal home for at least the past three years.

That program required an additional IRS form to accompany the federal tax filing, and it’s expected that the 2021 version of the tax credit will do the same. A USDA home loan is a zero-down-payment mortgage for eligible rural and suburban home buyers. Department of Agriculture through the USDA Rural Development Guaranteed Housing Loan Program.

Arizona First-Time Home Buyer Programs of 2021

Non-prime loans also do not have any waiting periods after a bankruptcy. In other states, you are not required to use a real estate agent for many loan program, such as conventional mortgages. However, some loan types require that you use a real estate agent regardless of your location, such as USDA loans. This program provides home buyers with an opportunity to receive up to 5% of your mortgage loan in down payment assistance. The assistance comes in the form of a “silent second mortgage”, which means that you do not have to make any payments on the money you receive.

In most cases, you won’t need to pay any down payment to get a USDA mortgage. Learn more about your options for mortgage loans by visiting Credible. You can compare lenders and mortgage rates to find a loan that’s right for you. The home must be your primary residence in the tax year it’s being claimed, and it must be purchased, as opposed to being acquired. In addition, you can’t claim the tax credit in another year, nor can you sell the home in the year that you try to claim the credit. However, as Bennett explained, income plays a role in the tax credit as well.

Tips for First-Time Home Buyers

Credit score of 620 or above Best For – Veterans earning a low monthly income The Department of Veterans Affairs insuresVA loansto help military families get a mortgage. Since many veterans tend not to have adequate income or savings to afford a typical 20% down payment after completing their service, VA loans do not require any down payment. The minimum down payment requirement will depend on the type of mortgage program.

Getting a 30-year, fixed-rate loan with less than 20% down typically requires monthly mortgage insurance, but with the Home Plus program, your premiums may be lower than usual. The program works with the government-sponsored enterprises Fannie Mae and Freddie Mac to offer mortgage insurance at a cost that’s lower than what you’ll see outside the Home Plus program. The U.S. Department of Veterans Affairs helps service members, veterans and surviving spouses buy homes.

When Can You Receive the $15,000 Tax Credit?

It’s a good idea, though, to be clear on each program’s specific eligibility standards before you start the application process. Below are some of the mortgage options that may be available to you. Imagine buying the home you wanted without the money you thought you needed.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals get started now. Finding a qualified financial advisor doesn't have to be hard.SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. To determine modified adjusted gross income , add to AGI certain amounts of foreign-earned income. Yes, the First-Time Homebuyer Act of 2021 is known by several names, including the Biden First-Time Homebuyer Tax Credit, the Biden Homebuyer Credit, and the $15,000 Homebuyer Tax Credit. The First-Time Homebuyer Act of 2021 aims to help low- and middle-income Americans attain homeownership.

Phoenix first-time home buyers

Conventional Loans– Conventional loans offer the best loan terms to borrowers with good or excellent credit, as well as those who can afford to place a larger down payment. Always ask your lender about any first-time homebuyer grant or down payment assistance programs available from government, nonprofit, and community organizations in your area. The IRS allows qualifying first-time homebuyers a one-time, penalty-free withdrawal of up to $10,000 from their IRA if the money is used to buy, build, or rebuild a home. The IRS considers anyone who has not owned a primary residence in the past three years a first-time homebuyer.

The income limit for single taxpayers is $75,000; the limit is $150,000 for married taxpayers filing a joint return. The tax credit amount is reduced for buyers with a modified adjusted gross income of more than $75,000 for single taxpayers and $150,000 for married taxpayers filing a joint return. The phase-out range for the tax credit program is equal to $20,000. That is, the tax credit amount is reduced to zero for taxpayers with MAGI of more than $95,000 or $170,000 and is reduced proportionally for taxpayers with MAGIs between these amounts. Eligible home buyers must be 18 years of age on the date of purchase, or married to a person who is 18 years of age.

But it would be well worth looking through them if you think you could benefit from the program. Home prices in Phoenix and Mesa are higher than the Arizona statewide average, though those in Tuscon are just a bit lower. Additionally, real estate prices rose over 25% between April 2021 and April 2022 for both Phoenix and Mesa, making Maricopa County a real estate hot spot in the Copper State. To learn more about this program, please visit the Arizona Department of Housing website.

Eligible K-12 teachers, first responders, military personnel and veterans, and individuals who earn up to $39,500 annually may receive an additional 1% in assistance. It is important to note that you cannot purchase a home from your ancestors (parents, grandparents, etc.), your lineal descendants (children, grandchildren, etc.) or your spouse. The first-time buyer program can be applied to any home that’s zoned for residential property. This includes trailer homes, mobile homes, and manufactured homes.

Note that AGI includes all forms of income including wages, salaries, interest income, dividends and capital gains. Single taxpayers with incomes up to $75,000 and married couples with incomes up to $150,000 qualify for the full tax credit. While each state runs its own version of the program, there are similarities between many states, and Arizona is no exception. Use this chart to find the median income for an area, then multiply that number by 1.6.

First time home buyers in Arizona have access to several excellent down payment assistance programs. This includes the Home Plus Mortgage Program, the Home in Five Program, the Pathway to Purchase program, and the Pima Tucson Homebuyers Solution. In addition to the requirements above, it’s also important to note there is a chance you’ll have to repay some or all of the homebuyer act’s assistance. For each year the buyer lives in the home, the repayment amount decreases by 20%.

That said, almost any lending program has credit qualifications. That’s why it’s important to take all possible steps to improve your credit standing before you go house hunting. Remember that the Arizona state and county programs offer many of these same loans, along with that forgivable second loan for a down payment or closing costs. So if you meet the income limits, that might be the way to go.

No comments:

Post a Comment